Optimize Your Investment: A Detailed Appearance at the EB-5 Visa Opportunity

The EB-5 Visa program provides an engaging avenue for international investors seeking irreversible residency in the USA via calculated economic dedications. With differing financial investment thresholds and the capacity for substantial economic influence, this program not only facilitates migration but additionally lines up with wider goals of task creation and area advancement. Navigating with the complexities of the application procedure and understanding the connected dangers are important for taking full advantage of the benefits of this opportunity. As we check out these components, essential understandings will certainly emerge that might greatly affect your investment method.

Overview of the EB-5 Visa

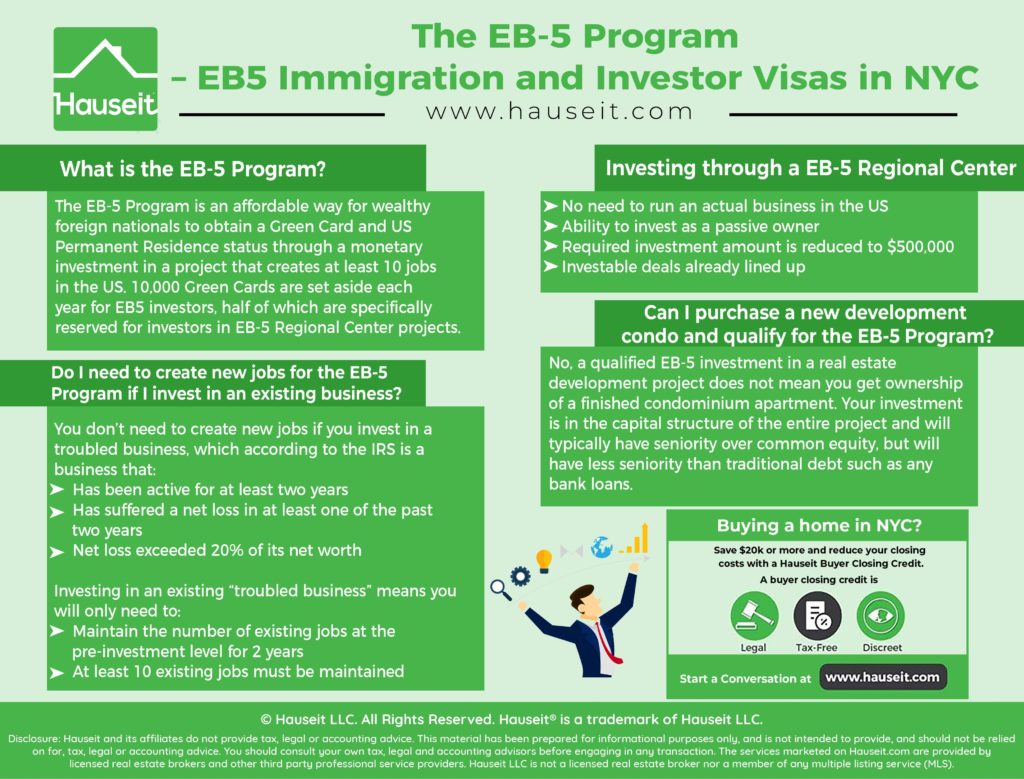

The EB-5 visa program supplies a distinct path for international investors seeking irreversible residency in the USA, enabling them to obtain a visa by spending in united state businesses. Established by the Migration Act of 1990, the program intends to boost the united state economic climate through capital financial investment and work creation. It is made for individuals who can satisfy certain standards, including the investment of a minimum needed amount in a new company.

The EB-5 program is notable for its emphasis on work development; investors need to show that their investment will produce or protect a minimum of 10 full-time work for U.S. employees. This concentrate on economic advantage straightens with the program's goal of attracting foreign resources to enhance neighborhood economic climates. Additionally, the EB-5 visa makes it possible for financiers and their instant member of the family to reside in the united state while enjoying the benefits of long-term residency.

Financial Investment Needs and Choices

Investors curious about the EB-5 visa program should stick to specific financial investment requirements that dictate the minimal capital essential for eligibility. As of 2023, the conventional financial investment quantity is $1 million. If the investment is directed towards a Targeted Work Location (TEA)-- defined as a country location or one with high joblessness-- the minimum demand is reduced to $800,000. (EB-5 Visa by Investment)

The EB-5 program provides 2 primary methods for investment: Direct Financial investment and Regional Center Financial Investment. Direct investment involves the financier investing or developing in a new company that creates at the very least 10 permanent jobs for certifying U.S. employees. This route may need more energetic participation in business operations.

On The Other Hand, Regional Facility investment allows financiers to add to pre-approved jobs taken care of by assigned Regional Centers. This option frequently offers a more passive investment chance, as the Regional Center takes on the obligation of job production and conformity with EB-5 laws.

Advantages of the EB-5 Program

Taking part in the EB-5 program opens up a path to various advantages for international investors looking for united state residency. One of the primary advantages is the possibility for investors and their immediate member of the family to get a united state visa, granting them permanent residency. This condition permits people to live, function, and research throughout the USA, providing access to a wide range of opportunities and sources.

In addition, participants in the EB-5 program advantage from the security and safety and security related to U.S. residency, consisting of the protection of properties and the ability to take a trip openly in and out of the country. In general, the EB-5 program offers a distinct chance for international capitalists to gain residency while contributing to the united state economy, making it an attractive choice for those looking for new starts.

Job Development and Economic Effect

The EB-5 visa program plays an essential role in stimulating job development and cultivating financial development in the United States. By attracting foreign investment, it not only produces new job opportunity but also enhances neighborhood economies. Comprehending the program's effect on work markets and economic advancement is essential for potential financiers and neighborhoods alike.

Task Development Prospective

Using the possibility of the EB-5 visa program can substantially add to task development and financial development within targeted areas. The program mandates that each international investor contribute a minimum of $900,000 in a targeted work area (TEA) or $1. EB-5 Investment Amount.8 million in various other areas, with the goal of preserving or developing a minimum of 10 permanent work for united state workers. This requirement not just incentivizes international financial investment yet likewise boosts neighborhood economic climates by producing job opportunity

Projects moneyed through the EB-5 program frequently concentrate on sectors that are critical for development, such as property hospitality, growth, and facilities. These efforts can lead to the facility of new businesses, growth of existing firms, and inevitably, a stronger labor force. Additionally, the increase of capital from EB-5 capitalists permits the undertaking of large tasks that would or else be impractical, thus boosting task creation possibility.

Along with direct work, the causal sequence of work creation includes secondary solutions and industries, promoting a durable economic setting. The EB-5 visa program, subsequently, plays a critical duty in driving job development and sustaining neighborhood communities, making it a critical investment possibility.

Financial Development Payments

EB-5 capitalists' payments to financial development prolong past mere job creation, encompassing a broad range of positive effect on local and local economies. By investing a minimum of $900,000 in targeted employment locations or $1.8 million in non-targeted locations, these capitalists help with the establishment and expansion of companies, which revitalize community infrastructures and services.

The funding increase from EB-5 financial investments commonly results in the development of new industrial jobs, property ventures, and important solutions. This not just creates find this straight work possibilities yet additionally promotes indirect job growth within sustaining markets, such as building and construction, retail, and friendliness. EB-5 Investment Amount. Enhanced business task improves tax earnings, giving regional federal governments with additional sources to money public services and framework enhancements.

The broader financial impact of the EB-5 program consists of raised consumer costs, enhanced building values, and boosted area amenities. Consequently, areas that draw in EB-5 investments often experience a revitalization of local economic situations, cultivating an atmosphere for sustainable development. Ultimately, the EB-5 visa program functions as an effective tool for economic development, benefiting both capitalists and the neighborhoods in which they invest.

The Application Refine Explained

The application procedure for the EB-5 visa involves a number of critical steps that possible investors need to navigate to safeguard their visa. Comprehending the qualification needs is crucial, as this foundation will certainly lead applicants through each stage of the procedure. In the complying with sections, we will outline these demands and give a comprehensive step-by-step guide to effectively finishing the application.

Qualification Needs Overview

Navigating through the qualification needs for the EB-5 visa can be an intricate process, but understanding the crucial parts is necessary for possible capitalists. The EB-5 visa program is designed for foreign nationals seeking permanent residency in the United States through financial investment in a new industrial business. To qualify, an applicant should invest a minimum of $1 million, or $500,000 in targeted employment areas (TEAs), which are specified as rural or high-unemployment regions.

Additionally, the investor needs to show that the investment will certainly develop or preserve at the very least 10 full time tasks for certifying united state employees within two years. It is also important for the applicant to prove that the funds utilized for investment are legally gotten, demanding detailed documents of the resource of funding.

Additionally, the investor needs to be actively involved in business, although this does not call for daily monitoring. Compliance with these eligibility requirements is essential, as failure to meet any kind of requirements can cause the rejection of the visa. Understanding these parts not just aids in preparing a durable application however also boosts the probability of efficiently navigating the EB-5 visa procedure.

Step-by-Step Process

Steering via the application process for an EB-5 visa requires an organized method to assure all demands are fulfilled efficiently. The primary step includes choosing a suitable investment task, ideally within a marked Targeted Work Area (TEA) to maximize benefits. After determining a task, it is vital to perform extensive due diligence to analyze its viability and compliance with EB-5 regulations.

Next off, candidates should prepare Type I-526, Immigrant Application by Alien Investor, outlining the financial investment's source of funds and economic impact - EB-5 Investment Amount. This form is come with by sustaining paperwork, including evidence of the financial investment and evidence of the project's job production capacity

Upon approval of Kind I-526, candidates can proceed to obtain an immigrant visa via consular processing or readjust condition if currently in the U.S. This entails submitting Form DS-260, Application for an Immigrant Visa and Alien Enrollment.

Common Difficulties and Considerations

Steering the EB-5 visa process offers several usual difficulties and factors to consider that potential financiers must meticulously examine. One primary worry is the significant monetary investment called for, which presently stands at $1.05 million or $800,000 in targeted employment locations. This significant funding commitment necessitates detailed due diligence to assure the task is feasible and lines up with the capitalist's financial goals.

An additional challenge is the prolonged handling times connected with EB-5 applications, which can expand past 2 years. Financiers should be planned for possible hold-ups that can affect their immigration timelines. Additionally, the requirement to preserve or produce a minimum of ten permanent work can make complex job choice, as not all endeavors assure job creation.

The danger of financial investment loss is an essential factor to consider. Financiers need to seek jobs with a strong track document and clear monitoring to mitigate this risk. Modifications in immigration policies and regulations can impact the EB-5 program's stability, making it important for financiers to stay informed about legal advancements. A complete understanding of these challenges will certainly make it possible for possible capitalists to make educated decisions throughout the EB-5 visa process.

Success Stories and Instance Studies

The EB-5 visa program has made it possible for various financiers to accomplish their immigration goals while adding to the united state economic climate through task creation and capital investment. A notable success tale is that of a Chinese entrepreneur that purchased a regional facility concentrated on eco-friendly energy. His investment not just protected his family's visas yet likewise facilitated the development of over 200 jobs in a having a hard time neighborhood, illustrating the program's twin benefits.

Another engaging case entails a group of capitalists who merged resources to create a high-end hotel in a municipal area. This task not only produced significant employment possibility yet also renewed the local tourist sector. The capitalists effectively gotten their visas and have given that broadened their organization portfolio in the united state, more showing the possibility for growth with the EB-5 program.

These instances highlight just how tactical financial investments can result in individual success and more comprehensive economic influence. As prospective financiers take into consideration the EB-5 visa, these success stories function as a verification of the program's potential to change lives and areas alike, encouraging further participation in this beneficial opportunity.

Often Asked Concerns

What Is the Regular Handling Time for an EB-5 Visa?

The normal handling time for an EB-5 visa varies, commonly varying from 12 to 24 months. Factors influencing this timeline consist of application volume, private conditions, and regional center approvals, impacting general processing effectiveness.

Can My Household Join Me on the EB-5 Visa?

Yes, your family members can join you on the EB-5 visa. Partners and single children under 21 are eligible for derivative visas, allowing them to acquire long-term residency alongside the primary applicant in the EB-5 program.

Exist Certain Industries Preferred for EB-5 Investments?

Yes, particular markets such as realty, friendliness, and framework are usually favored for EB-5 financial investments. These markets commonly show solid development capacity, task development capacity, and alignment with U.S. financial advancement goals.

What Happens if My Financial Investment Falls short?

It may threaten your qualification for the EB-5 visa if your investment falls short. The United State Citizenship and Immigration Services needs proof of task creation and funding in danger; failure to fulfill these might lead to application denial.

Can I Live Throughout the United State With an EB-5 Visa?

Yes, holders of an EB-5 visa can stay throughout the USA. This adaptability enables financiers and their families to pick their recommended places based upon individual demands, employment possibility, and lifestyle choices.

The EB-5 visa program provides a distinct path for foreign investors looking for permanent residency in the United States, allowing them to acquire a visa by investing in United state companies. Capitalists interested in the EB-5 visa program need to adhere to certain investment needs that dictate the minimal funding essential for eligibility. The EB-5 program offers 2 primary opportunities for investment: Direct Investment and Regional Facility Financial Investment. Comprehending these financial investment requirements and choices is essential for prospective capitalists aiming to navigate the intricacies of the EB-5 visa program successfully. The EB-5 visa program has actually allowed numerous financiers to attain their migration goals while adding to the U.S. economy with job creation and funding financial investment.